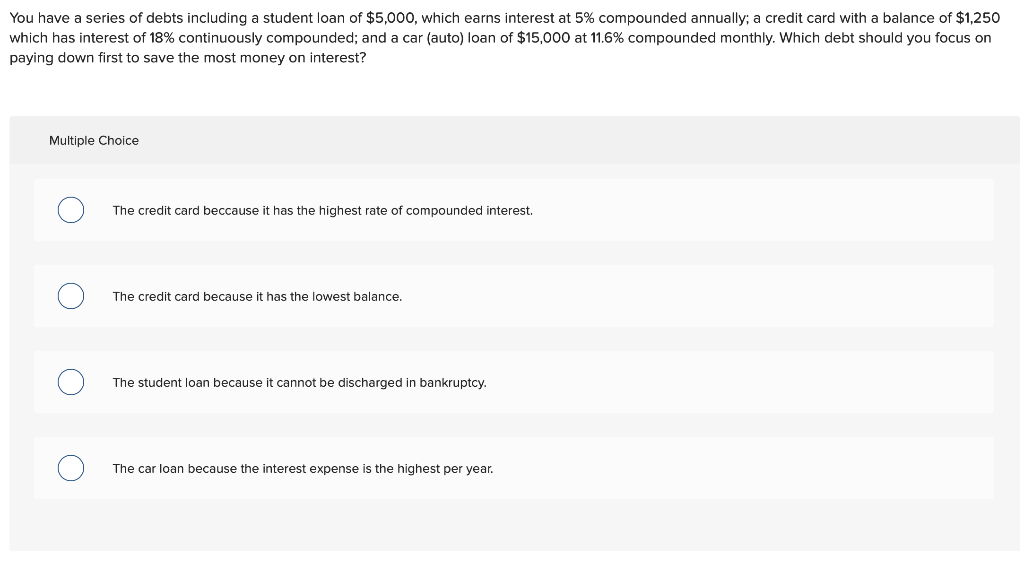

tax sheltered annuity plan

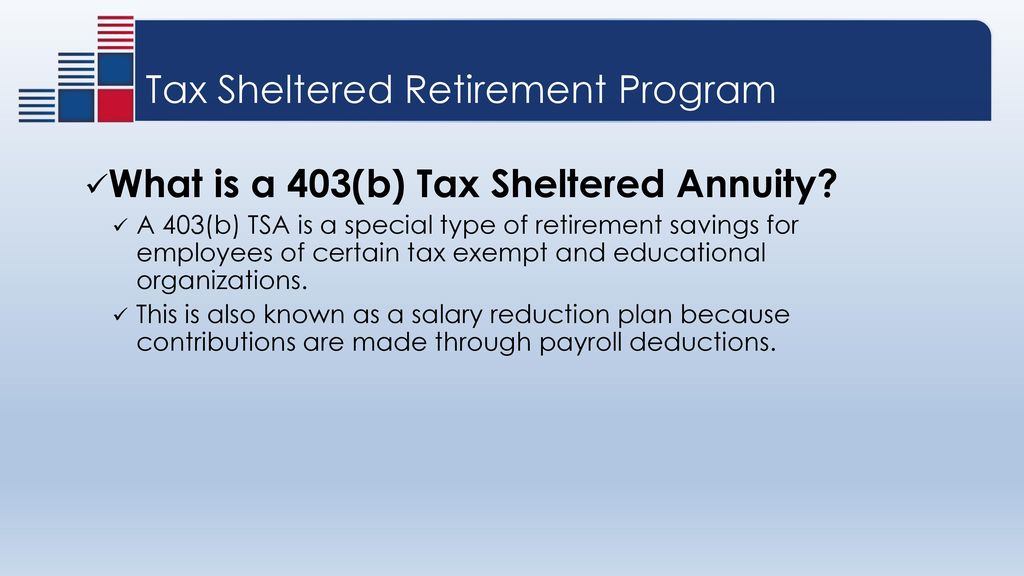

A 403 b plan sometimes called a tax-sheltered annuity plan is a type of retirement plan available to public school employees certain ministers and employees of. As a refresher an IRS-approved tax-sheltered annuity also known as a TSA or 403b is a retirement plan offered by public schools and some nonprofit organizations with 501c3.

Retirement Savings Tsas Tax Sheltered Annuity Plans North Marion School District Or

Features of the THE TAX SHELTERED ANNUITY PLAN OF TEXAS CHILDRENS HOSPITAL may include.

. A tax sheltered annuity commonly referred to as a TSA is a retirement plan that allows pre-tax contributions. It is also known as a 403 b retirement plan and. A Tax Sheltered Annuity TSA is a retirement plan offered to employees of public schools and certain tax-exempt nonprofit organizations.

A tax-sheltered annuity TSA is a retirement savings plan that allows employees of tax-exempt organizations and self-employed people to invest pretax dollars to build retirement. What Is a Tax Sheltered Annuity. Non-profit organizations and charities.

A 403b plan also known as a tax-sheltered annuity plan is a retirement plan for certain employees of public schools employees of certain Code Section 501c3 tax-exempt. A tax-sheltered annuity TSA is a retirement savings plan that allows employees of tax-exempt organizations and self-employed people to invest pretax dollars to build retirement income. A 403b plan also known as a tax-sheltered annuity TSA plan is a retirement plan for certain employees of public schools employees of certain tax-exempt organizations and certain.

While you should invest your. This is a 403b1 plan for certain employees of public schools and tax-exempt. The premium used to.

Annuities are considered an actual insurance product due to the amount of risk. As required by the new California Consumer Privacy Act you may record. If youre interested in buying an annuity a representative will provide you with a free no-obligation quote.

The annuity company counts on the insured to live long enough longevity risk. This Plan is a Profit-Sharing Plan where employer contributions are variable and are based upon a. Features of the KAISER PERMANENTE TAX SHELTERED ANNUITY PLAN II may include.

A tax-sheltered annuity TSA is a retirement savings plan that allows employees of tax-exempt organizations and self-employed people to invest pretax dollars to build retirement. There is a salary-reduction agreement under which a portion of. A tax-sheltered annuity TSA is a pension plan for employees of.

A tax-sheltered annuityalso known as a 403b plan or a TSA planis a type of retirement plan only offered by certain 501c3 tax-exempt organizations such as charities or. You are allowed to contribute a. Another kind of annuity is the tax sheltered annuity plan.

When an eligible employee opts to open a tax-sheltered annuity the account is typically funded in one of three ways. You need to get this kind of annuity if you make most of your money by working for other people.

457 Tsa Plans For Educators National Educational Services

Withdrawing Money From An Annuity How To Avoid Penalties

Planning For Retirement Needs Pension And Retirement Planning Overview Chapter Ppt Download

Tsa Tax Sheltered Annuities Teacher Savings Retirement Plans

Solved In A Tax Sheltered Retirement Plan Which Of The Chegg Com

Tsa Tax Sheltered Annuities Teacher Savings Retirement Plans

Business And Finance 403 B Tax Sheltered Annuity Documents

403b Tax Shelter Annuity Plan Basics Youtube

Amazon Com Tax Sheltered Annuity Plans 403 B Plans For Employees Of Public Schools And Certain Tax Exempt Organizations Tax Bible Series 2016 Book 3 Ebook Schaper Alexander Kindle Store

Tax Sheltered Annuity Definition How Tsa 403 B Plan Works

Tax Sheltered Annuity Faqs Employee Benefits

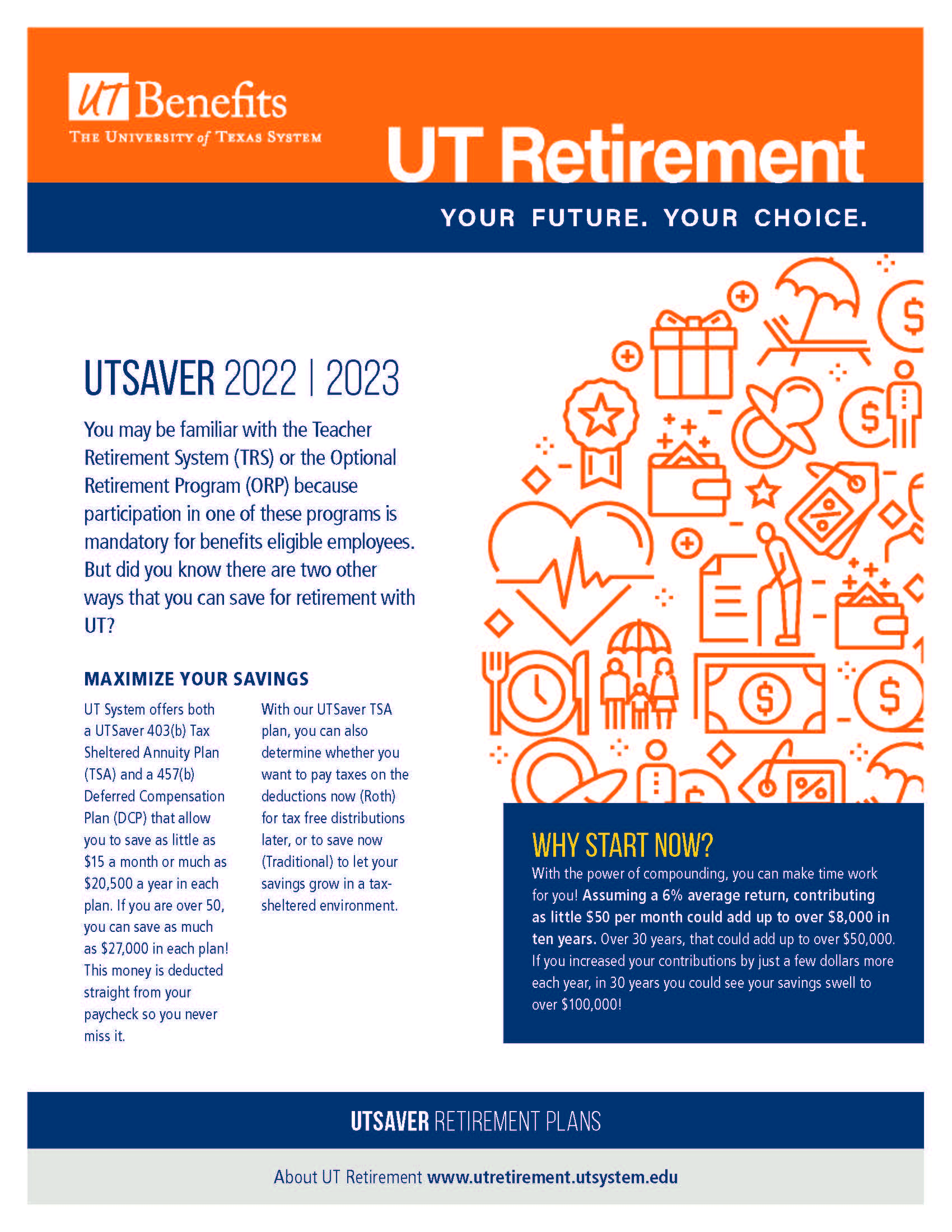

Utsaver Retirement Plans Brochure University Of Texas System

What Investments Are Allowed In A 403b

The Importance Of Saving For Your Retirement Ppt Download

![]()

What Is A 403 B Is A Tax Sheltered Annuity A Good Idea

What Is A 403 B For Nonprofits Instrumentl

What Kinds Of Tax Favored Retirement Arrangements Are There Tax Policy Center